Portfolio Benchmarking

Benchmark: Income & Capital Preservation Portfolio

For our Income & Capital Preservation portfolio, we have formulated a unique benchmarking allocation that reflects a prudent approach to investing, blending stability with potential for modest growth.

The asset allocation behind our benchmark is an average of three key components:

-

Morningstar's Conservative Benchmark Index

This index is a well-regarded benchmark in the industry, known for its emphasis on preserving capital while providing some exposure to growth assets. It serves as a solid foundation for our conservative strategy, ensuring that we maintain a cautious approach.

-

Fidelity's 2015 Target Date Fund

Target date funds are designed to gradually become more conservative as the target date approaches. By including the Fidelity 2015 Target Date Fund in our benchmark, we incorporate a strategy that has already transitioned to a conservative allocation, providing a real-world example of a low-risk portfolio.

-

Wealthfront's 0.5 Risk Portfolio

Wealthfront's risk score system offers a modern approach to portfolio construction, and their 0.5 risk portfolio represents a very conservative risk level. Including this in our benchmark allows us to capture the essence of tech-driven, low-risk investing, adding a contemporary perspective to our benchmark.

By averaging these three components, we create a comprehensive benchmarking allocation that balances traditional and modern approaches to conservative investing. This blend helps us measure the performance of our conservative portfolio against a cautious and diversified benchmark, ensuring that we are always aligned with our client's objectives of capital preservation and stability.

Conservative Allocation

*Disclaimer: Our managed client portfolio strategies utilize a blended average of Fidelity's Target Date Funds, Morningstar's Risk-Based Benchmarks, and Wealthfront's passive allocations to create a benchmarking allocation that guides our investment decisions. It's important to note that these allocations serve as a snapshot in time and are used to establish our benchmarks. As a result, our benchmarks will not change in response to fluctuations in these three allocations. This is because they may no longer accurately represent our target risk profiles over time. Our priority is to maintain benchmarks that consistently reflect our strategic investment objectives and the risk preferences of our clients. Past performance is not indicative of future performance.

Benchmark Allocation: Balanced Income & Growth Portfolio

DiversiFi’s Balanced Income & Growth portfolio is designed for clients seeking a balance between growth and capital preservation. To accurately measure the performance of this portfolio, we've crafted a benchmarking allocation that mirrors this balanced approach using a similar methodology:

-

Morningstar's Moderate Benchmark Index

This index is widely recognized for its balanced allocation between stocks and bonds, making it an ideal foundation for our moderate portfolio benchmark. It reflects a strategy that seeks both capital appreciation and income, aligning with the objectives of our moderate portfolio.

-

Fidelity's 2035 Target Date Fund

As noted above, target date funds are structured to gradually adjust their asset allocation over time. Fidelity’s 2035 Target Date Fund is positioned for investors with a medium-term investment horizon, offering a blend of growth & income assets. Including this fund in our benchmark allows us to incorporate a dynamic, real-world example of a moderate investment strategy.

-

Wealthfront's 5.0 Risk Portfolio

Wealthfront's 5.0 risk portfolio represents a moderate level of risk, balancing equity and fixed-income investments. This component adds a contemporary dimension to our benchmark, ensuring it remains relevant in today's investment landscape.

By averaging these three components, our benchmarking allocation captures the essence of a moderate investment strategy, which aims for a balance between growth and preservation. It serves as a valuable tool for evaluating the performance of our moderate portfolio, ensuring that we stay aligned with our client's goals of achieving long-term financial growth while managing risk.

Moderate Allocation

*Disclaimer: Our managed client portfolio strategies utilize a blended average of Fidelity's Target Date Funds, Morningstar's Risk-Based Benchmarks, and Wealthfront's passive allocations to create a benchmarking allocation that guides our investment decisions. It's important to note that these allocations serve as a snapshot in time and are used to establish our benchmarks. As a result, our benchmarks will not change in response to fluctuations in these three allocations. This is because they may no longer accurately represent our target risk profiles over time. Our priority is to maintain benchmarks that consistently reflect our strategic investment objectives and the risk preferences of our clients. Past performance is not indicative of future performance.

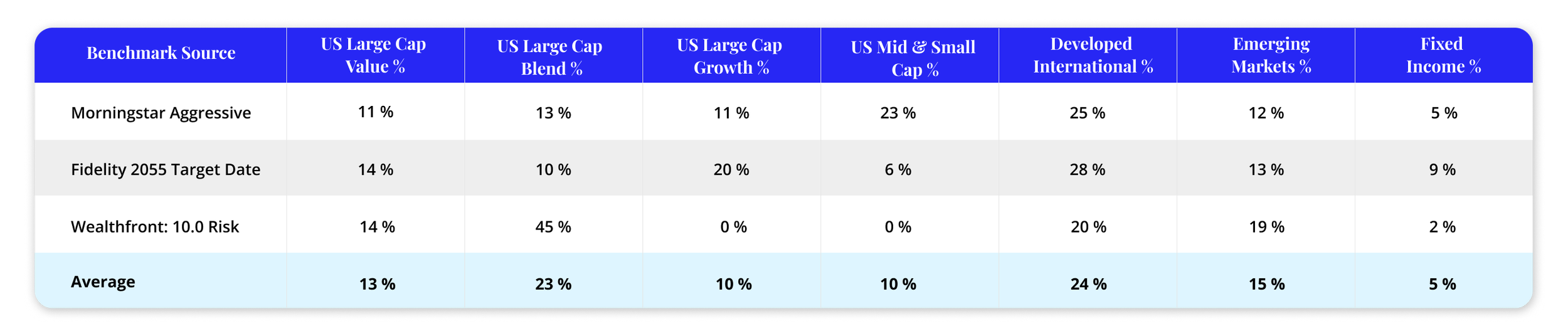

Benchmark Allocation: Capital Appreciation Portfolio

Finally, our Capital Appreciation portfolio is designed for clients primarily focused on long-term growth and are comfortable with a higher level of risk. To ensure that we have a suitable benchmarking allocation for evaluating the performance of this portfolio, we've constructed a benchmark that embodies an aggressive investment approach. Our benchmark for the Capital Appreciation portfolio follows the same methodology as our first two portfolios:

-

Morningstar's Aggressive Benchmark Index

This index is a popular choice for representing aggressive investment strategies, with a significant allocation to equities for growth potential. It serves as a robust foundation for our benchmark, reflecting our portfolio's emphasis on capital appreciation.

-

Fidelity's 2055 Target Date Fund

The Fidelity 2055 Target Date Fund is geared towards investors with a long investment horizon, making it more aggressive in its allocation. Including this fund in our benchmark provides a dynamic and forward-looking element, aligning with the growth-oriented nature of our portfolio.

-

Wealthfront's 10.0 Risk Portfolio

Wealthfront's 10.0 risk portfolio is at the higher end of the risk spectrum, strongly emphasizing equities. This component adds a modern touch to our benchmark, ensuring that it captures the essence of aggressive, tech-driven investing.

By averaging these three components, our benchmarking allocation captures the essence of an aggressive investment strategy, which aims for price appreciation through a high equity allocation. It serves as a valuable tool for evaluating the performance of our aggressive portfolio, ensuring that we stay aligned with our client's goals of achieving long-term financial growth and appreciation.

Aggressive Allocation

*Disclaimer: Our managed client portfolio strategies utilize a blended average of Fidelity's Target Date Funds, Morningstar's Risk-Based Benchmarks, and Wealthfront's passive allocations to create a benchmarking allocation that guides our investment decisions. It's important to note that these allocations serve as a snapshot in time and are used to establish our benchmarks. As a result, our benchmarks will not change in response to fluctuations in these three allocations. This is because they may no longer accurately represent our target risk profiles over time. Our priority is to maintain benchmarks that consistently reflect our strategic investment objectives and the risk preferences of our clients. Past performance is not indicative of future performance.

Methodology

With our benchmarking methodology squared away, we had to identify which funds to use for each asset class. In order to optimize for consistency in reporting for our clients, we leaned on our aggregation software, Blueleaf, to help inform our decisions here. As of the benchmarking formation, Blueleaf offered the following benchmarking options:

From this list of potential benchmark offerings, we then created an asset class mapping for the parts of the market that we were trying to identify within our benchmarks. The result of our asset class mapping can be found below:

*For mid & small cap, we use a 50/50 blend for benchmarking