From Overwhelmed to Empowered: Samantha’s Palantir IPO Journey

Disclosure:

This testimonial was given by a current client of DiversiFi Capital LLC, and it is not representative of all client experiences. No cash or compensation was given for or to elicit this testimonial.

To safeguard our client’s privacy, names and other identifying details have been altered. However, the core stories and experiences remain authentic.

Meet Samantha, an Engineer at Palantir. As the company prepared for its IPO, Samantha faced both the challenge and opportunity of navigating the complexities of her equity compensation awards. Having joined Palantir during its pre-IPO days, Samantha sought guidance from one of our experienced financial advisors, Lily, who specializes in equity compensation. Lily worked with Samantha to develop a strategic approach for managing her NSOs and RSUs during this integral time. Along the way, Lily also provided a tailored tax strategy to project future estimated quarterly taxes from her equity sales, along with an investment strategy for how to effectively manage her proceeds.

In this interview, Samantha shares how DiversiFi helped her successfully navigate this pivotal moment.

The Challenge

What challenges and/or opportunities did you face with your equity compensation as Palantir prepared for its IPO that led you to seek guidance from Lily? How did these challenges/opportunities make you feel at the time?

Samantha grew up with limited financial literacy, so when Palantir announced its IPO in 2020, she felt overwhelmed by the complexity of NSOs and RSUs. Wanting to make the most of the opportunity, she turned to DiversiFi for guidance and was matched with her advisor, Lily.

“I grew up with financial literacy essentially limited to a savings account, credit score, and general knowledge about the stock market. When Palantir announced that it was going to IPO in the second half of 2020, I knew I wanted to make the most of this opportunity - I did not want to fumble. However, I did not feel very interested in self-learning all of the terms and principles, and I was generally overwhelmed by all of the chatter that was starting to bubble up at work. It started to feel like I was in over my head, especially since I didn’t even really fully understand what my equity compensation would look like. Through a recommendation, I decided to reach out to DiversiFi.”

Lily’s Approach

How did Lily help you navigate and manage your Palantir NSO and RSU awards during Palantir’s IPO process? What was her approach? In developing and defining your strategy, what’s one thing that your Advisor did that stood out as valuable to you?

Samantha felt overwhelmed by her lack of understanding about managing equity. Unsure of where to start, she felt like everyone else had it figured out.

“When I first met Lily, I remember being candid about how overwhelmed I was feeling and how it seemed like everyone knew what to do with their equity except for me. From day one, Lily was very clear and patient with me as I asked her a variety of beginner questions (some questions I asked multiple times – sorry, Lily!) in addition to some more strategic questions as my knowledge grew.

Through a few assessments and initial conversations, I got a sense that she understood my risk tolerance, tentative goals, and general feelings about investments, given my age. She developed a comprehensive financial model that included the aforementioned factors, as well as the equity I was awarded and the savings I had accrued at that time. I was adamant about investing as much of the sales proceeds as possible, and Lily made it very easy for me to not only understand how much of each award I should exercise and sell per trading window but also which funds to invest in and why.

Over the years, Lily has tweaked my portfolio, helped me with taxes, and updated my financial strategy as I navigated raises, equity bumps, and getting married. Her empathy and expertise have helped me build financial confidence over the last few years.”

The Outcome

What outcomes did you achieve through Lily’s support and strategic equity compensation guidance? What were the highlights? What was the impact of these outcomes? Thinking back, how did your feelings around this event differ before working on a strategy with Lily, versus after? What changed for you?

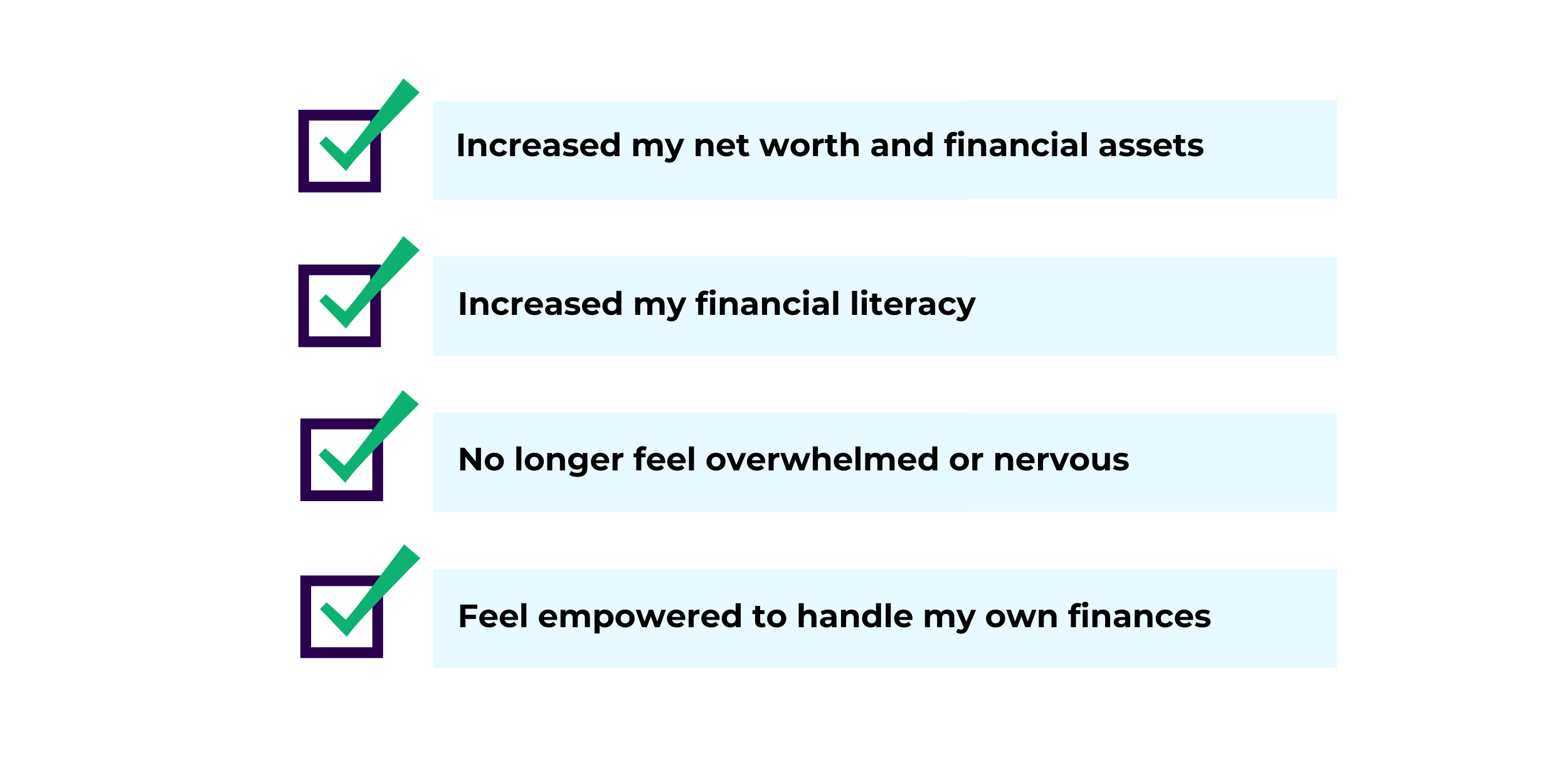

Samantha was able to increase her net worth and financial assets.

“With Lily’s support and guidance, I built up a healthy investment portfolio, navigated the vesting and exercising of various types of equity, rebalanced my 401k, adjusted to market trends, and received suggestions for what to execute per trading window. From a purely numerical basis, the investments have been paying off year-to-year, and I feel like I have a robust set of financial assets.”

She increased her financial literacy through Lily’s guidance and now feels empowered to handle her own finances.

“A huge highlight from working with Lily has been the realization that my own financial literacy has grown a considerable amount to a point where I have a full understanding of my finances. The stock market doesn’t feel like a nebulous web of individual bets anymore but more like a system with logical levers that I can push or pull when needed. My equity is much more straightforward to me now than before the DPO. Additionally, I no longer feel overwhelmed or nervous when chatting about financial strategy, and I now have much more substantively strategic conversations with Lily over email and video calls. Thinking back, reaching out to DiversiFi and working with Lily has been one of the smartest decisions I could have made before Palantir went public.”

Recommend?

Would you recommend Lily and DiversiFi to other Palantir employees or those in similar situations who are preparing for an IPO? If so, why? What’s one thing you would want them to know about working with us?

“I would absolutely recommend Lily and DiversiFi as a whole to other Palantir employees or anyone who finds themselves at a company that is about to go public. The combination of DiversiFi's fiduciary nature, personalized partnership, and emphasis on education means that the client experiences a trusted and approachable foray into personal finance. If you partner with DiversiFi, you can expect to work with friendly and nonjudgmental experts who encourage you to get as personally involved with making trades and opening accounts as you want but also don’t mind spelling new concepts out along the way.”

DiversiFi’s Final Thoughts

We understand how intimidating and overwhelming creating an equity compensation strategy, especially during an IPO, can feel and when you're a newbie to financial planning at the crossroads of potentially a life-changing opportunity. In the case of Samantha, when Palantir announced its IPO in 2020, she knew she needed to act quickly to make the most of the moment and do something with her NSOs and RSUs, but she didn’t know where to start or who to turn to. That is where her advisor, Lily, came in and was really able to make a positive impact on her experience.

Having worked with many clients in Samantha’s position, Lily knew how to approach Samantha’s situation in a way that aligned with her long-term and short-term goals while easing her fears and uncertainties. Lily worked closely with her to assess her goals, risk tolerance, and tax situation, creating a tailored financial strategy that simplified the complexity of her equity awards. But Lily didn’t stop at crafting recommendations on how much stock to exercise or how to build an investment plan that would optimize returns. This wasn’t about short-term solutions or checking off tasks for Lily.

She got to know Samantha as a person and learned what was really important to her during different stages of her equity journey and life events, tailoring her advice to each of those stages. She also worked to empower Samantha to take control of her finances through thoughtful and continuous guidance and education. Today, Samantha feels confident managing her equity awards and her finances, thanks to Lily’s support.

Ready to get started on your financial wellness journey?

DiversiFi Capital LLC is a registered investment adviser located in CA and may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Any communications with prospective clients residing in jurisdictions where DiversiFi Capital LLC is not registered or licensed shall be limited so as not to trigger registration or licensing requirements.

Past performance is not indicative of future returns, and investing always carries inherent risks, including the potential loss of principal capital. Any investment strategies are specific to individual clients and may not be representative of the experiences of all clients.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed.