Wealth Management

Our Wealth Management service helps you work toward your investment goals by letting our team manage your assets. Our job is to execute your investment strategy in a way that is strategic, tax-efficient, and aligned with macroeconomic changes.

Let us do the heavy lifting.

Wealth Management alleviates your need to actively monitor, analyze, and make trades on your investments. Our team actively manages your investments within Charles Schwab, focusing on agility, data, and performance.

Through our Financial Planning Service, you will work closely with your Advisor to develop an investment strategy that is the same regardless of how you choose to deploy the strategy. Whether you choose to manage your investments yourself, work with another firm, or decide that DiversiFi’s Wealth Management service is a good fit, your investment strategy is at the core.

Your Investment Strategy will articulate which accounts to keep vs. consolidate, the risk level of your future investments, and how to invest your cash & savings going forward. Our recommendation for how to manage your assets will rely on your comfort level, time commitment, and investing experience.

Our Wealth Team continuously monitors and analyzes critical macroeconomic data points. They leverage this data to adapt our investment portfolios to ever-changing market conditions and current events.

You do not need to be enrolled in Financial Planning to sign up for our Wealth Management service. We do our best to accommodate all clients, regardless of how much you have to invest.

Whether you’re just starting to save or have $1M+ ready to invest, our goal is to make investing more accessible.

Is Wealth Management Right for Me?

While Wealth Management isn’t always for everyone, we believe that it’s important to discuss if and when investing should be part of your financial plan. It’s hard to thrive in the modern world and combat inflation without investing. Investing early and often will help you to fund your life goals, like buying a home, paying for your child’s education, and enjoying your retirement.

Investing can be daunting even to someone with a degree in Finance. You need to know the difference between mutual funds, ETFs, stocks, bonds, etc., and be able to analyze economic data to make informed decisions on what to invest in, while also making trades, rebalancing your portfolio, and switching out positions for tax benefit. Our Wealth Team leverages years of knowledge and experience to take this work off your hands.

Wealth Management might..

-

Be a great fit for you if:

You find it difficult to invest in the market due to many unknowns and macroeconomic factors.

You want to collaborate with an Advisor to make decisions related to allocating your investments.

You find that personally managing your investment strategy and making regular adjustments is taking away time from advancing your career or spending it with your family.

You are not sure what stocks or mutual funds to buy or sell given the multiple available investments.

You would be less stressed and more confident working with an expert to collaboratively make investment decisions.

-

Not be the right fit for you if:

You are an avid DIY investor and are highly skilled & motivated to research your own investment opportunities.

You are disciplined, resilient, and very rarely susceptible to popular trends and rash investment decisions.

You have the time to tend to your investments and don’t mind the nitty-gritty work related to making trades & rebalancing your portfolio.

You prefer investments that are beyond the scope of our services and would rather pursue these opportunities independently.

Benefits of Wealth Management

Investment accounts are set up in your name, with privacy guardrails to give you peace of mind with someone else managing your money.

A dedicated team member who takes care of the work related to transferring and consolidating your accounts, reducing the level of effort and stress of getting started.

On-demand support for all ongoing maintenance, such as depositing or withdrawing funds, changing portfolios, and changing your beneficiary or account registration.

Daily trades for new deposits, monthly rebalancing, and quarterly tax loss harvesting to ensure that your accounts remain in alignment with your investment strategy.

Live performance tracking dashboard that can be accessed at any time.

Continued investment strategy discussions with your advisor during every meeting.

What to Expect

Our Portfolios

Pricing

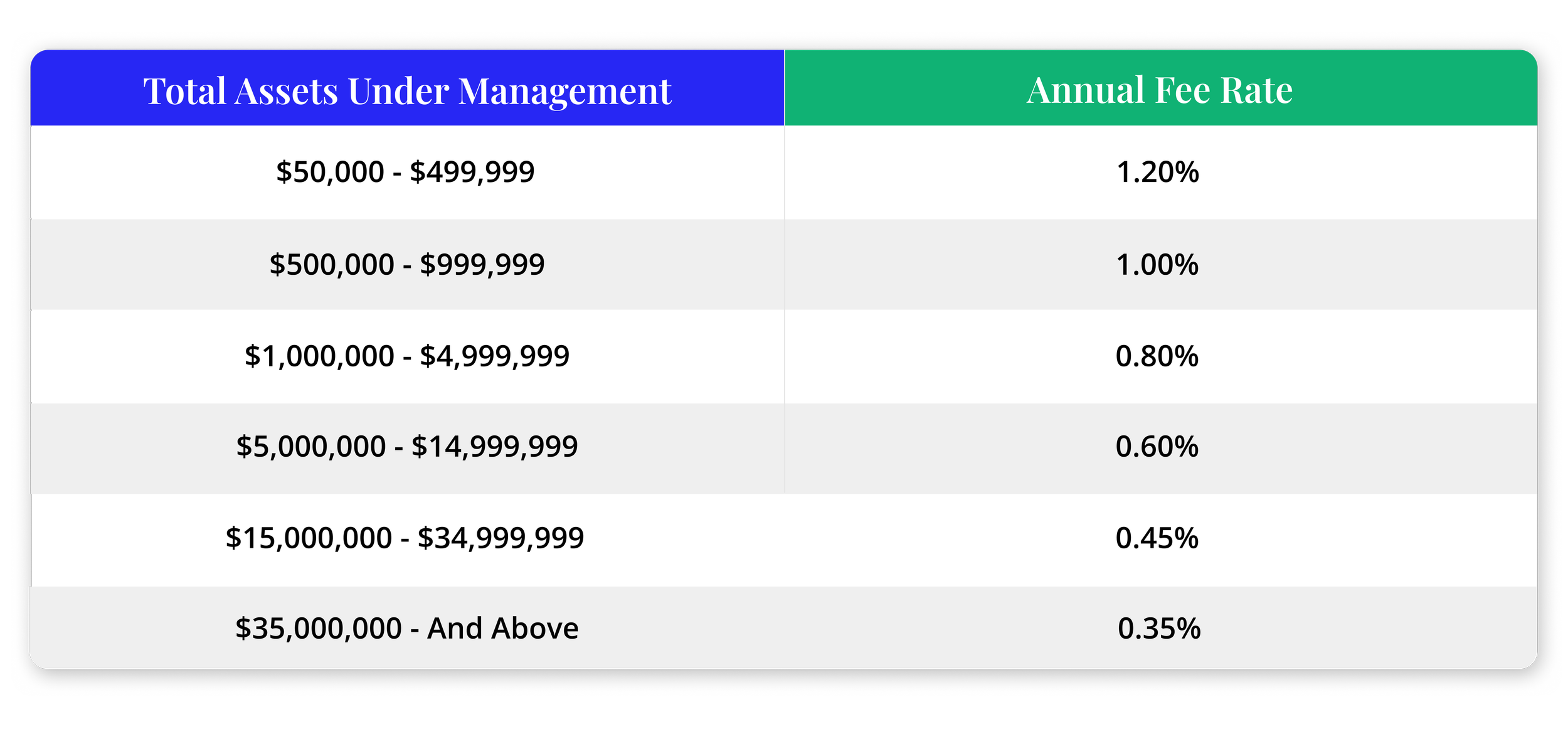

We provide a progressive fee structure that is based on the total Assets Under Management (AUM) with DiversiFi. Should your investment amount change between the tiers in the table below, all assets fall into that new rate. Your account will be billed monthly, pulling fees from your managed account at Charles Schwab.