Growing Together: Anna & Steve’s Equity Compensation Journey Through the Milestones

Disclosure:

This testimonial was given by a current client of DiversiFi Capital LLC, and it is not representative of all client experiences. No cash or compensation was given for or to elicit this testimonial.

To safeguard our client’s privacy, names and other identifying details have been altered or omitted. However, the core stories and experiences remain authentic.

Starting Out in Starter: First Job, Big Goals

When Anna first joined DiversiFi in 2019, she was just getting started. She was navigating the second role of her career after graduate school at Meta and earning a high income for the first time. But like many early-career professionals in tech, she had more questions than answers about saving, investing, the tangibility of Meta equity compensation, and making her money work.

At the time, her top goal was simple but ambitious: to buy a home on the Peninsula in the Bay Area, where high rents made the idea of ownership feel urgent, but also out of reach. During this time, Anna had limited knowledge of her equity compensation, the stock market, or where to begin with financial planning. Alfred, her advisor, began by focusing on building a strong foundation: understanding different types of accounts, starting to save intentionally, understanding equity compensation, and building up a cash cushion.

Buying First Home

As Anna advanced in her career at Meta, her growing income gave her greater flexibility to save and spend intentionally. With Alfred’s guidance, she was able to accelerate her progress and reach her goal of buying a home in just two years.

Additionally, Anna initially thought her home budget was more limited. But with Alfred’s support, along with a strong income and a consistent savings plan, she was able to stretch further than expected without putting her other financial goals at risk.

Buying her home became a major turning point. What once felt like a long-term dream turned into a reality much sooner than planned, proving the power of a clear strategy followed by disciplined execution. Today, Anna’s home continues to serve as a cornerstone of her financial foundation.

Getting Married: Joining Lives & Finances

In mid-2021, Anna married Steve. They began working toward shared goals, and Alfred’s focus shifted to helping them operate as a financial team. This included:

Educating Steve on his Apple equity comp and 401(k)s

Navigating job and income changes for Anna & Steve

Managing and diversifying concentrated stock

Aligning on shared savings and investment strategies

Alfred also worked with them to build mutual understanding around income, spending, and planning for future big decisions as a unit.

Progression from Starter into Core

As Anna and Steve’s lives evolved, so did the complexity of their finances. Throughout their time working with Alfred, both changed jobs. Anna moved from Meta to Google, and Steve transitioned from Apple to a smaller company in pursuit of greater impact and growth. Each move came with new equity packages, compensation structures, and planning opportunities that required deeper guidance.

Once Anna purchased a home, she began building significant equity. She and her husband were also preparing to grow their family. With two strong incomes, a shared set of goals, and increasingly complex decisions, their financial life naturally progressed beyond the Starter stage.

This marked their transition into our Core tier, designed for dual-income clients (often married) with equity compensation, navigating major life events like homeownership, career transitions, and starting a family. With Alfred’s help, Anna and Steve moved from learning the fundamentals to making confident, strategic choices. As their life situation evolved, Alfred continued to grow with them, offering the next level of support for everything ahead.

From First Steps to Family Milestones: Where They Are Now

Today, Anna and Steve live the life they worked hard to build. They feel grounded, confident, and aligned in managing their finances as a family.

Their wealth has grown significantly. They've moved well beyond the basics with a strong investment portfolio, healthy retirement savings, and tangible equity in their home. They’re thinking ahead, planning purposefully, and making decisions from a place of clarity.

Earlier this year, they welcomed their first child. It was a joyful milestone, and one they were truly ready for. The financial foundation they built made it possible to focus on being present, not stressed. Parenthood also brought new planning goals, like getting life insurance, beginning to consider education savings, and working with Alfred on estate planning and the creation of a will.

They’re also in the process of remodeling their home. What started as a modest project turned into something more thoughtful. After talking with Alfred, they decided to invest a bit more to make their home work for the long term. Instead of just getting by, they’re creating a space they can grow into and enjoy for years.

Anna and Steve have come a long way—from a first job and early questions about saving to a life that reflects their values and goals. Like many clients at this stage, they are now solidly in our Core tier, with a clear path toward Plus on the horizon. With Alfred’s guidance, they continue to move forward with purpose, ready to embrace new opportunities and milestones ahead.

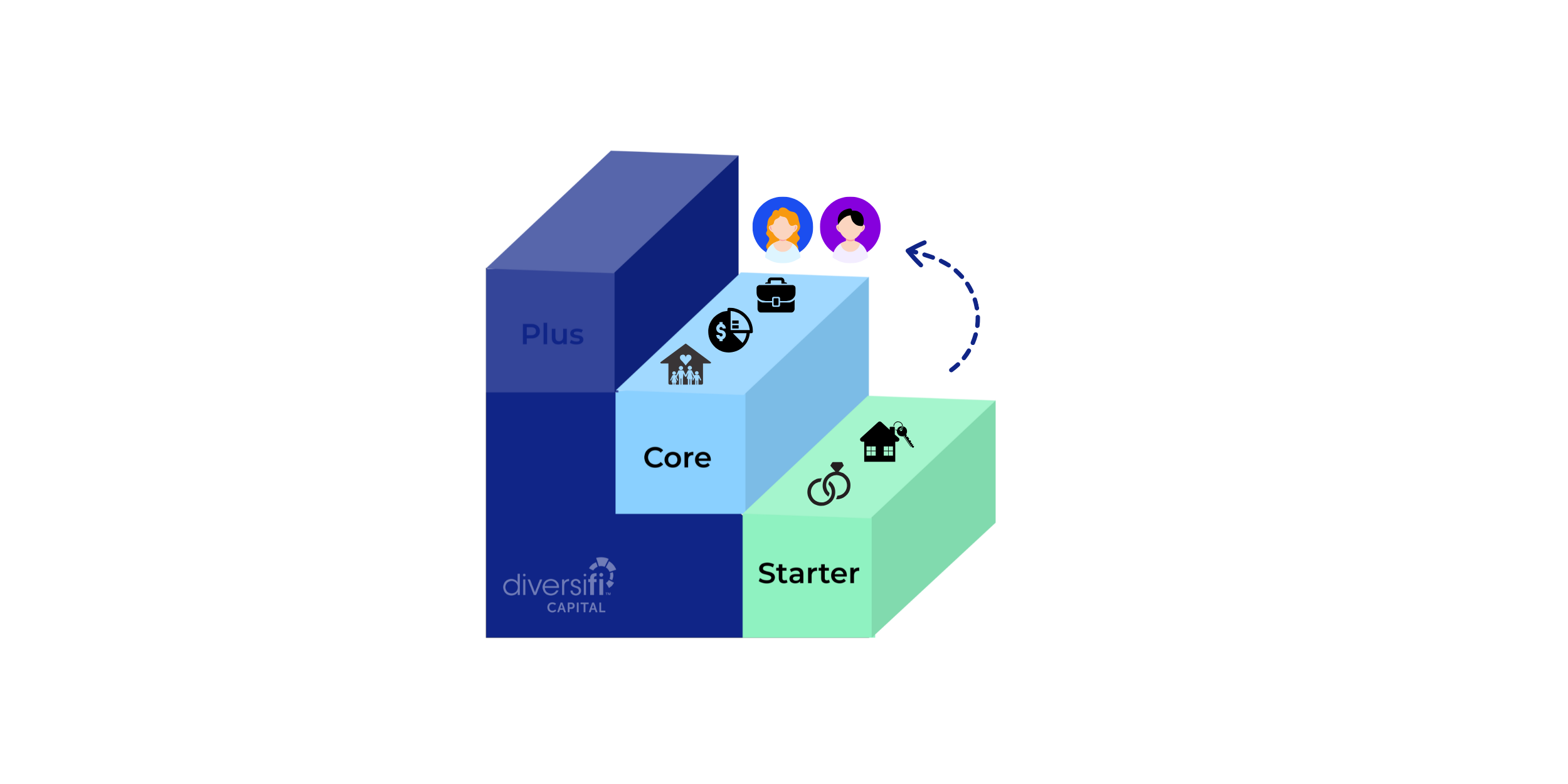

Our Financial Planning levels: We evolve with you.

We’re here to meet you where you are, and help you grow from there:

Starter: Ideal for early-career professionals ready to build a strong financial foundation. As your career, income, and life milestones, like marriage, buying a home, or starting a family, evolve, Starter clients often move into Core.

Core: Built for busy mid-career professionals managing career, family, home, and equity planning. Core guidance helps you navigate complexity and make confident financial decisions.

Plus: Designed for high-net-worth clients, founders, and senior leaders handling wealth transfer, multi-year planning, and sophisticated financial strategies.

Click here to get started and get matched to the level and the advisor that is best suited to handle your situation and needs.

In Their Own Words

Describe in your own words the impact Alfred’s guidance has had on your financial journey and outcomes. What are some highlights? Include your feelings before and after the outcomes that were achieved.

“It is hard to overstate the impact our partnership with Alfred has had on our lives. Acting as more than just our money guy, Alfred helps us take a holistic approach to financial decisions. I jokingly called him “my financial therapist” when buying our house; but it’s actually a really fitting description. Alfred not only helps us figure out the numbers, but he also helps us make decisions that are aligned with our values and our goals as a family. We’ve gone from being initially a little worried about disclosing so much personal information to going to Alfred as a partner for every major financial decision.”

Ready to get started on your financial wellness journey?

DiversiFi Capital LLC is a registered investment adviser located in CA and may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Any communications with prospective clients residing in jurisdictions where DiversiFi Capital LLC is not registered or licensed shall be limited so as not to trigger registration or licensing requirements.

Past performance is not indicative of future returns, and investing always carries inherent risks, including the potential loss of principal capital. Any investment strategies are specific to individual clients and may not be representative of the experiences of all clients.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed.