Private Market Investing 101

When most people think about investing, they picture the stock market and companies such as Apple, Microsoft, or Amazon trading on public exchanges. But there’s a whole other side of the investment world that’s not as visible, yet just as powerful: private markets.

In this post, we explain what private market investing is, why people invest in private markets, what the tradeoffs are of investing, and who is typically eligible to invest.

What is Private Market Investing?

Private market investing refers to investing in companies that aren’t listed on public stock exchanges. Instead of buying shares through your brokerage account, you’re putting capital directly into businesses that raise funds privately.

These are typically startups and growth-stage companies that are not yet publicly traded. They raise money through venture capital rounds, often in exchange for equity, long before they’re acquired or go public through an IPO.

Through an exclusive services offering called DiversiFi Ventures, we help certain eligible clients (Qualified Clients) access this growing and traditionally exclusive asset class. Our private market offerings are designed around two key entry points:

Angel/Seed Stage Investing – Get in at the ground floor by backing startups with high potential and big vision.

Late Stage (Pre-IPO) Investing – Ride the final wave of private growth by investing in companies on the cusp of going public.

This approach allows our clients to participate in private company growth, from early innovation to late-stage momentum.

Why Do Private Markets Matter to Investors?

Private markets could be an important addition to an investor’s allocation strategy because they now represent more value creation than public markets.

Longer private growth periods: Companies are staying private two to three times longer than they used to.

Growth before IPO: The biggest growth often happens well before an IPO, which most public investors never get access to.

Access to high-growth tech companies: Increasingly, investors need to tap into private markets to gain exposure to the world’s most exciting and fastest-growing large technology companies.

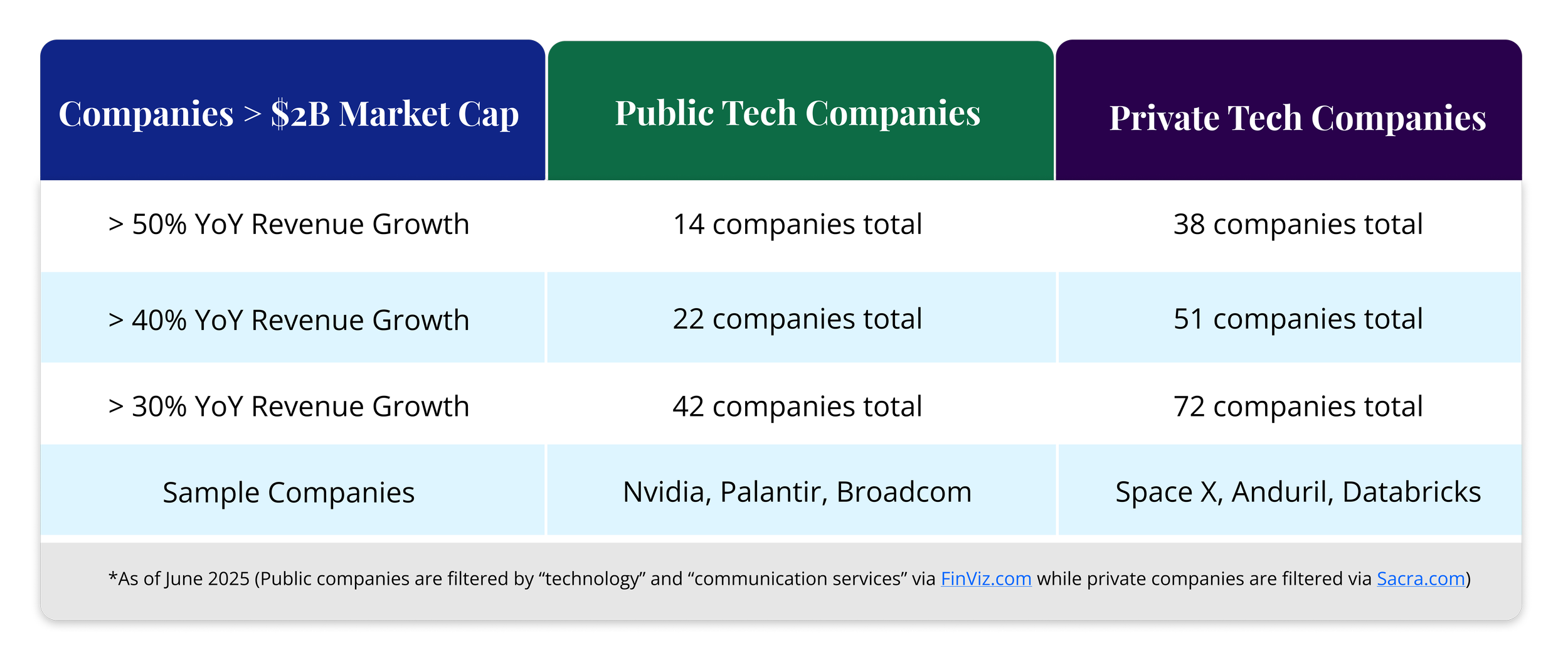

The table below compares high-growth public and private technology companies with a market capitalization greater than $2 billion. It highlights how private companies outperform public peers at nearly every revenue-growth tier, illustrating why private markets are increasingly important for investors seeking exposure to fast-growing, innovative businesses.

Why Do People Invest in Private Markets?

Diversification

Private assets often behave differently from public stocks, helping reduce correlation and smooth out overall portfolio volatility.Access to Innovation

Some of today’s most prominent public companies started in private portfolios. Investing early can mean exposure to the next game-changing technology before it hits the market.Potential for Higher Returns

While not guaranteed, early investments in high-growth companies can lead to outsized gains, especially if those companies eventually exit via IPO or acquisition.Tax Strategy Opportunities

Depending on the structure, private investments can offer meaningful tax deferral or favorable treatment (like QSBS exclusions for eligible startups).

What are the Tradeoffs to Private Market Investing?

While private market investing can be exciting and potentially lucrative, it’s not without tradeoffs:

Illiquidity: These investments are long-term commitments. Your money could be tied up for 5–10 years or more.

Higher Risk of Loss: Especially with startups, there's a high failure rate. Not every company makes it.

Less Transparency: You won’t get quarterly earnings calls or daily price charts.

Complexity: From K-1 tax forms to capital calls, private investments often come with more paperwork and fewer standard processes.

Who Can Typically Participate in Private Market Investing?

Private market investments are not open to the general public. Access is generally limited to individuals or entities that meet certain financial and legal requirements, primarily to protect less-experienced investors from high-risk or illiquid investments.

Here are the main categories of eligible investors:

1. Accredited Investors

Most private offerings (like venture capital, private equity, or pre-IPO deals) are only available to accredited investors.

You qualify if you meet one or more of the following:

Income: Earned at least $200,000 in each of the past two years (or $300,000 combined with a spouse or partner) and expect the same this year.

Net Worth: Have a net worth over $1 million, either individually or jointly with a spouse/partner (excluding your primary residence).

Professional Certification: Hold specific financial licenses like a Series 7, Series 65, or Series 82.

2. Qualified Clients (for fee-based private funds)

Some private fund managers also require investors to be Qualified Clients, which is a step above “accredited.”:

You qualify if you meet either of the following:

Have $2.2 million or more in net worth (excluding your primary residence)

Have $1.1 million or more in assets under management (AUM) with the advisor offering the investment

3. Institutions or Trusts

Large institutions, trusts, or business entities may also qualify to invest if they meet certain asset thresholds (usually $5 million or more).

Final Thoughts

Private market investing is a behind-the-scenes opportunity to support the businesses shaping tomorrow today. While it’s not available to everyone, it’s becoming a bigger part of how modern investors diversify, grow, and innovate with their portfolios.

By accessing the private markets early and intelligently, you can open the door to higher potential returns, greater diversification, and earlier entry into industry-changing innovation.

DISCLOSURES

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed.

The investment opportunities in this communication are limited to qualified clients only. The SEC has requirements for individuals or companies wishing to purchase securities not registered with the SEC, such as private equity. DiversiFi Capital will share opportunities with clients for whom investments may be suitable and with clients who meet the investor status requirements.

Investments involve risk and, unless otherwise stated, are not guaranteed. The past performance provided is not indicative of future performance. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including investments and/or strategies recommended by DiversiFi), or product referenced directly or indirectly in this communication will be profitable. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or investment strategy will be suitable for a prospective client’s investment portfolio.